All Categories

Featured

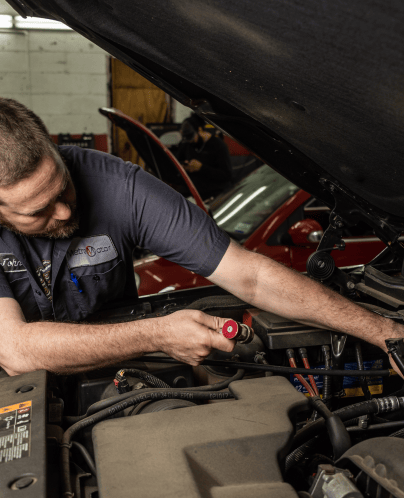

When your car requires a major repair work, the price can commonly be frustrating, particularly if you weren't expecting it. Whether it's an engine rebuild, transmission substitute, or extensive bodywork, these kinds of repair work can in some cases cost thousands of dollars. Fortunately, there are several funding choices available to help ease the burden. Right here's a breakdown of the ideal financing options for major automobile repair work.

- Vehicle Service Center Funding. Lots of auto service center supply in-house funding plans that can be an excellent choice for those who require instant fixings however do not have the funds available upfront. These strategies may feature flexible settlement terms and rate of interest prices, enabling you to pay off the repair prices gradually.

Pros: Comfort, as the funding is supplied straight by the shop. If you pay off the balance within a particular time framework, it may also come with no-interest promotions. Disadvantages: Some in-house financing strategies may have greater rate of interest if the balance is not paid off in complete within the marketing period. Furthermore, they may not be offered at all service center. 2. Individual Fundings. If you're searching for even more adaptability, an individual finance from a bank or lending institution can be a terrific alternative. Personal lendings generally use reduced interest rates contrasted to bank card and allow you to borrow a bigger amount of cash to cover the expense of repair services.

Pros: Taken care of rate of interest, foreseeable monthly settlements, and bigger loan quantities are readily available. You can utilize the funding for any kind of function, consisting of automobile repair work. Disadvantages: Authorization for a personal lending relies on your credit history rating. Rates of interest can differ, and it might take a bit longer to secure the loan. 3. Debt Cards. Utilizing a charge card is just one of one of the most common means to finance a significant lorry repair work. If you currently have a charge card with a low-interest price or an advertising 0% APR period, this can be a cost effective option.

Pros: Quick accessibility to funds if you currently have a charge card with available credit history. Some bank card use 0% APR for a collection duration (normally 6 to 18 months), enabling you to expand payments without paying passion. Cons: Rate of interest prices can be high after the advertising duration ends, and missing repayments could harm your credit report. It is necessary to repay the balance as quickly as feasible to prevent high interest charges. 4. Home Equity Loan or Line of Credit. If you possess your home and have significant equity developed, a home equity funding or credit line (HELOC) may be a feasible choice to finance a major repair work. These financings permit you to borrow against the value of your home, typically with reduced rate of interest than personal loans or charge card.

Pros: Generally lower rate of interest and longer repayment terms compared to other financing alternatives. You can obtain a larger quantity, which may be beneficial for expensive repair work. Cons: Utilizing your home as collateral implies that if you stop working to pay off the lending, you run the risk of losing your home. Furthermore, the approval procedure can take longer than with individual fundings or credit score cards. 5. Auto Fixing Loans. Some specialized lending institutions provide vehicle fixing car loans developed especially for car repairs. These loans work similarly to personal finances however are customized to assist with car-related expenses. You might be able to safeguard a loan for major repair services such as engine or transmission work.

Pros: Reduced rates of interest than charge card and flexibility to make use of the financing for details vehicle repairs. The finance application procedure might be simpler compared to personal financings from a financial institution. Cons: These loans might call for an excellent credit rating for approval, and not all lenders supply them. 6. Cash Advance (Not Suggested) While payday advance might seem like a quick service, they are typically not a recommended alternative as a result of their high-interest prices and short settlement terms. Payday advance are usually tiny finances due completely by your next cash advance, often with steep charges attached.

Pros: Quick access to pay if you remain in an emergency circumstance. Cons: Incredibly high rates of interest and charges, causing a cycle of financial obligation. Missing a repayment can cause severe monetary effects, consisting of worsening your credit history. 7. Insurance coverage Protection. If your fixing is related to a mishap or if your automobile has a guarantee, your insurance company or the guarantee supplier might cover some or all of the costs. Thorough insurance or prolonged service warranties can aid balance out pricey repair work if they're covered by your policy.

Pros: No demand to pay out-of-pocket if the fixing is covered. Insurance policy or warranty service providers might likewise offer help in discovering relied on fixing stores. Cons: You may still require to pay an insurance deductible, and not all fixings will be covered under basic automobile insurance policies. 8. Mechanic Payment Strategies. Some repair service stores provide credit choices, enabling you to arrange your repayments with time. These strategies can occasionally include minimal or no rate of interest if paid off within a specific duration.

Pros: Adaptable terms and no rate of interest if paid off within the agreed-upon amount of time. Cons: These plans may just be readily available at particular stores, and the terms can vary. Conclusion. Picking the appropriate financing alternative for a significant lorry fixing depends on a number of variables, including the overall expense of repair work, your credit history circumstance, and your capacity to pay back the car loan or credit in a prompt manner. Auto repair shop funding, personal car loans, bank card, and home equity fundings all have their disadvantages and pros, so it's essential to consider your alternatives meticulously. Always compare rates of interest, repayment terms, and charges before dedicating to a funding service to ensure you obtain the finest offer for your situations.

Latest Posts

Optimizing Your Ceramic Tile Guarantee Insurance Coverage

Published Jan 07, 25

2 min read

Experience the A-Abel Roofing Difference

Published Jan 07, 25

1 min read

Trusted Tinley Park Roof Repairs and Replacements - A-Abel Roofing

Published Jan 07, 25

1 min read